Why Choose EasyFees?

Why Choose EasyFees?

Save Time

Easily manage all types of fees, including Outbound and Inbound.

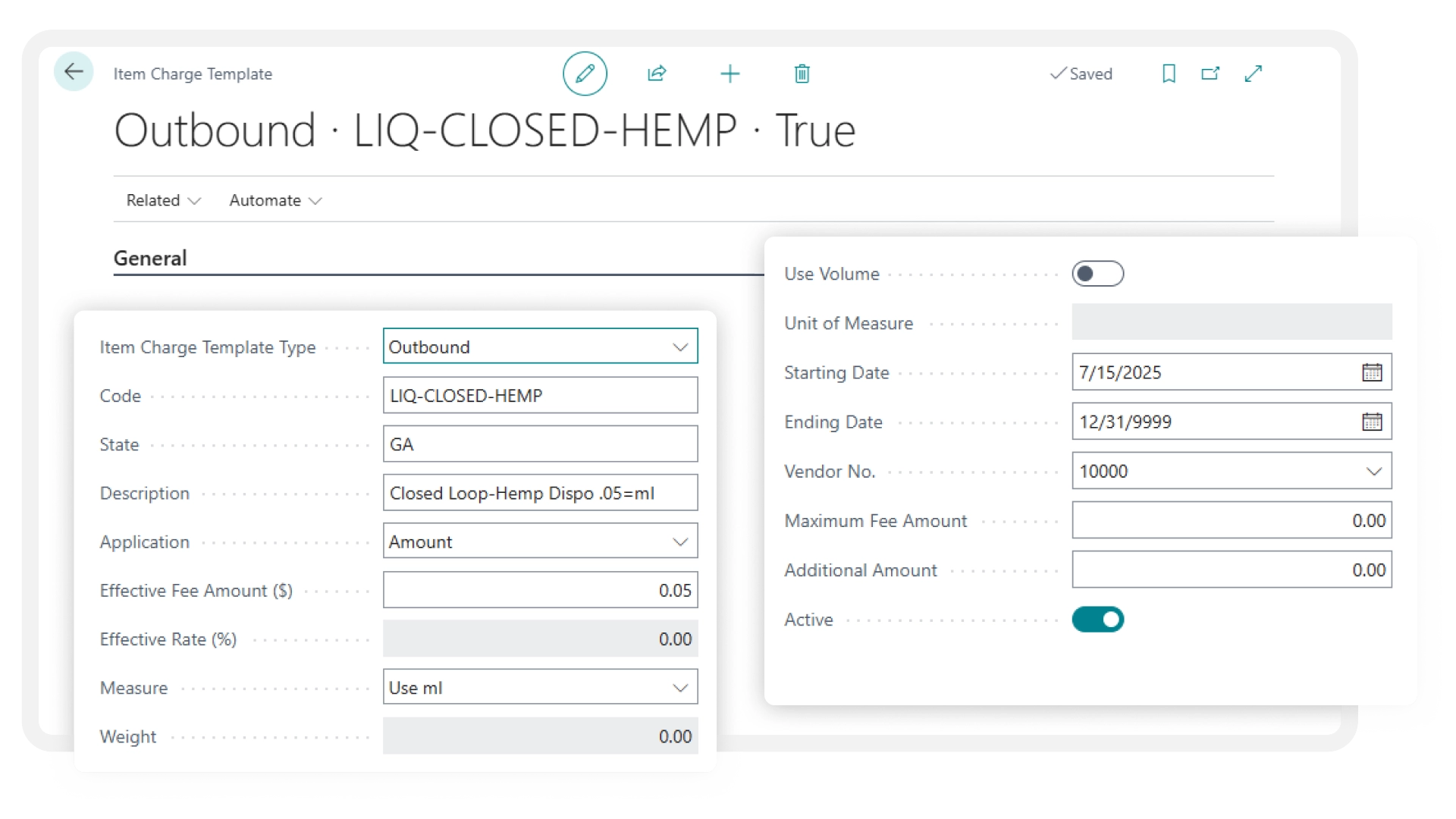

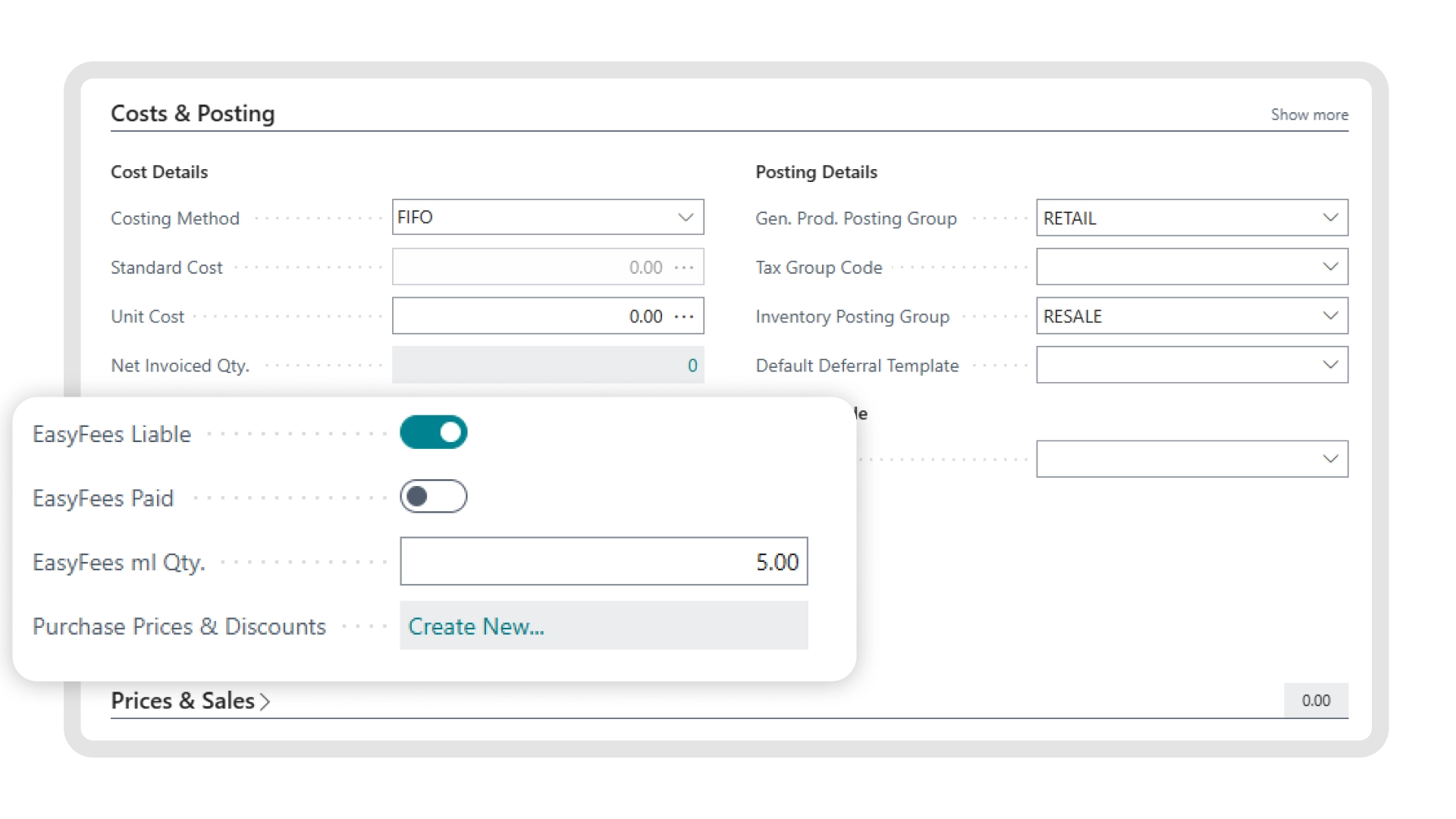

Flexible Templates

Create customized templates and assign them to items for precise fees calculations.

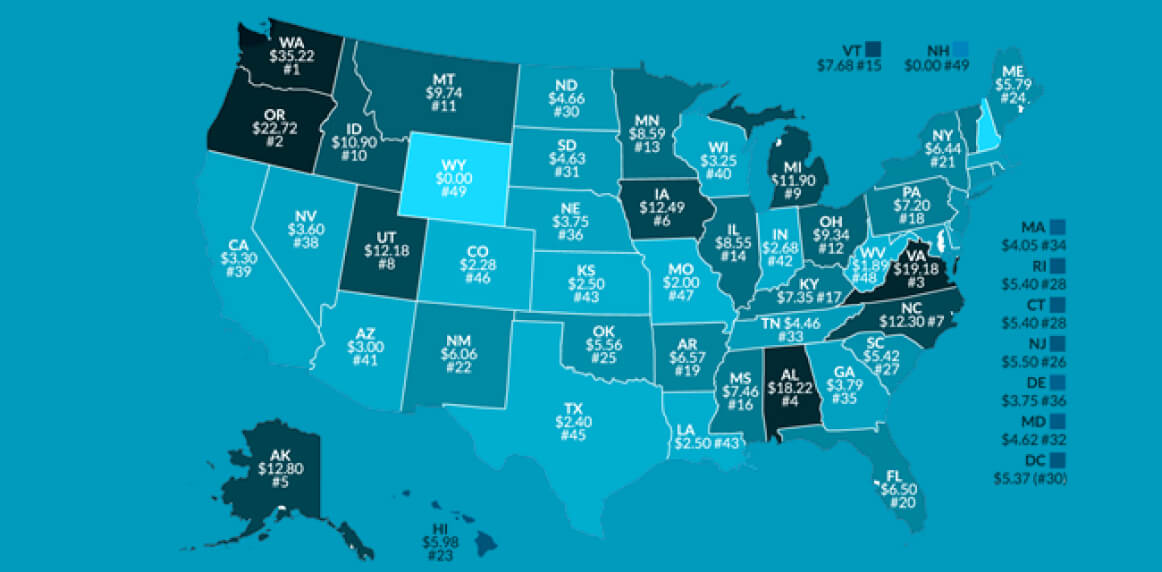

Unlimited Jurisdictions

Configure unlimited jurisdictions and tax rules to meet all regulatory requirements.

Increase Efficiency

Compatible with Dynamics 365 Business Central and the LS Central Application Family, making it the perfect fit for your business.

Stay Compliant

Ensure accuracy with customizable templates and detailed reports.

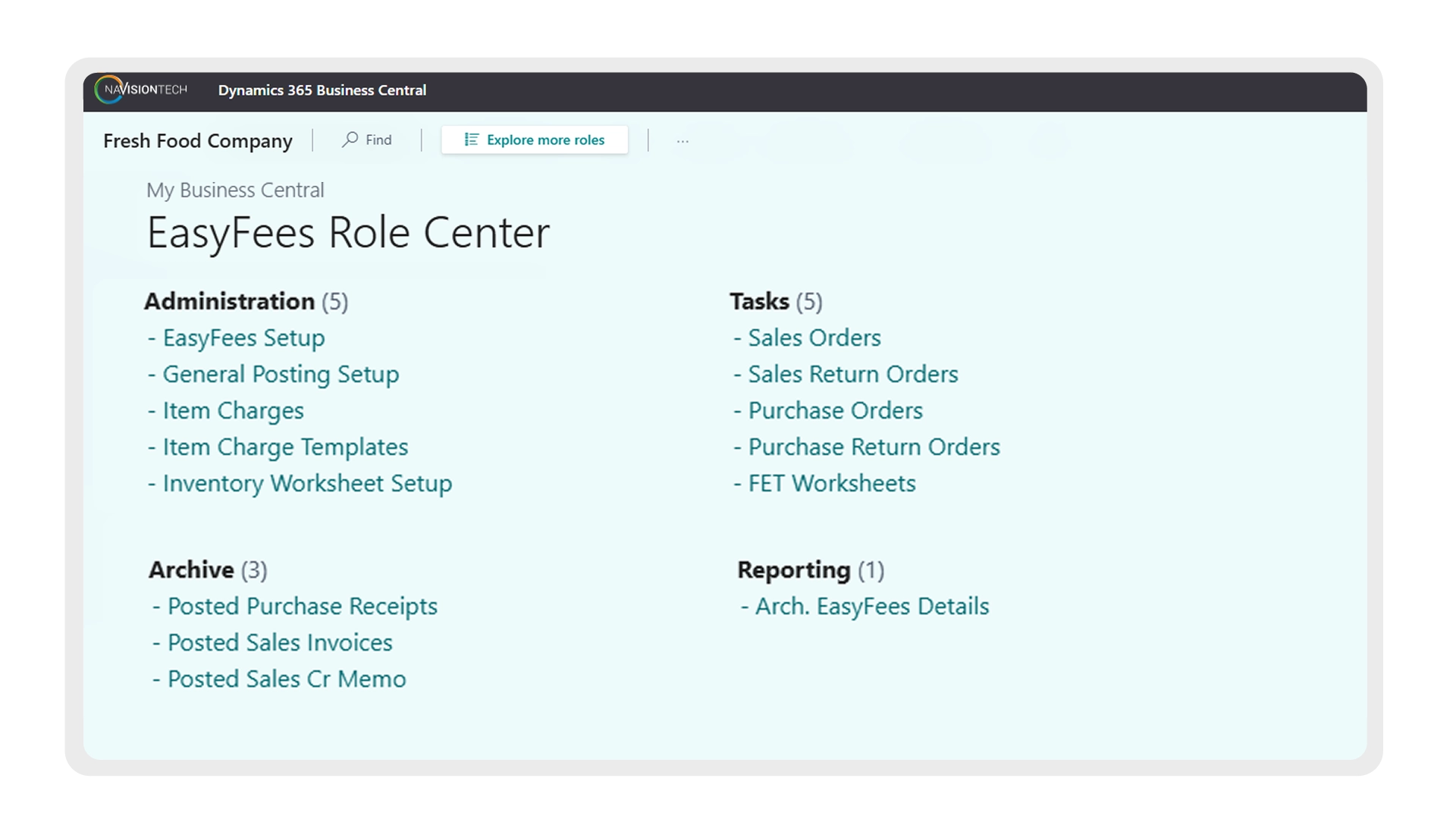

Key Features

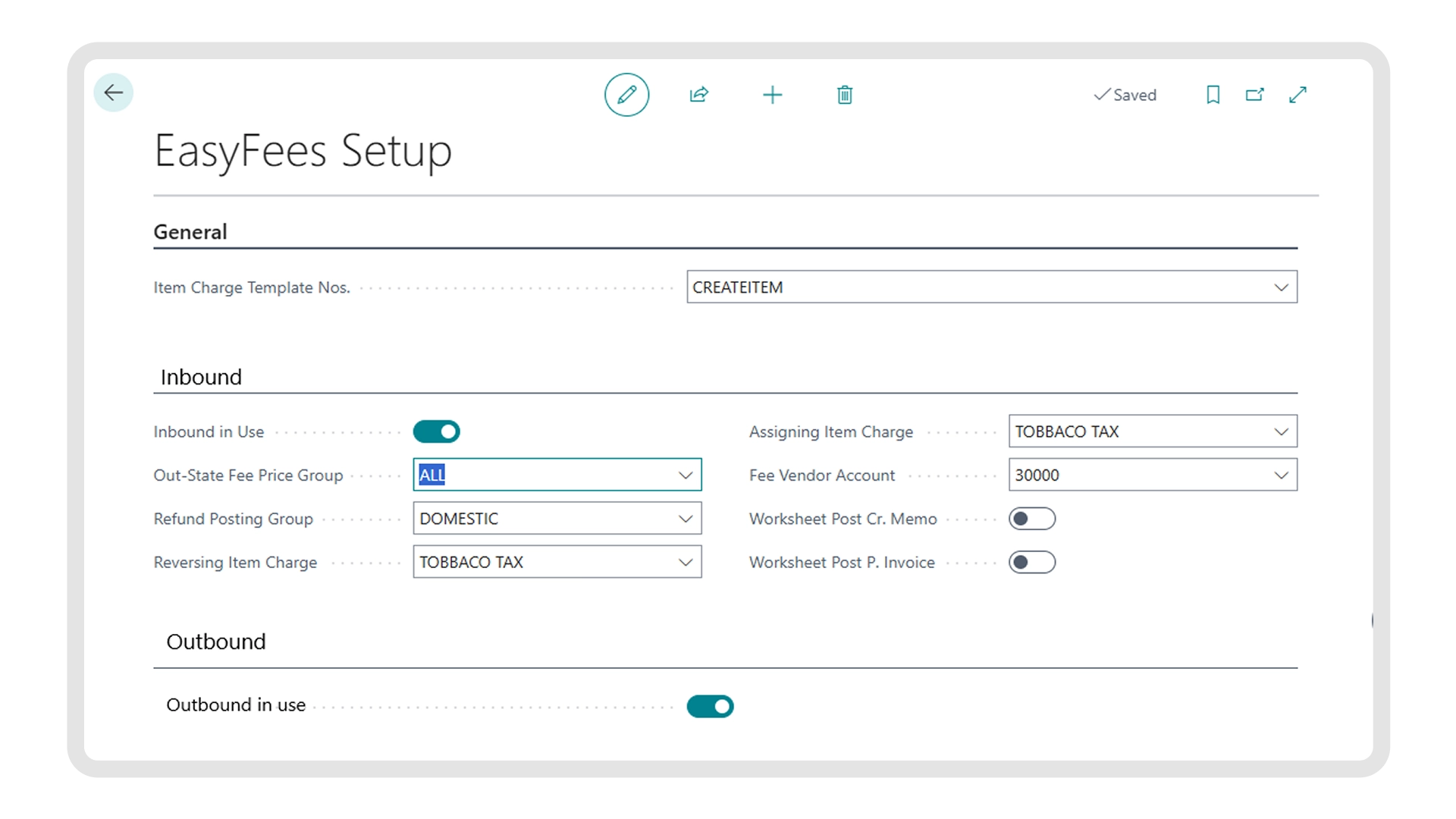

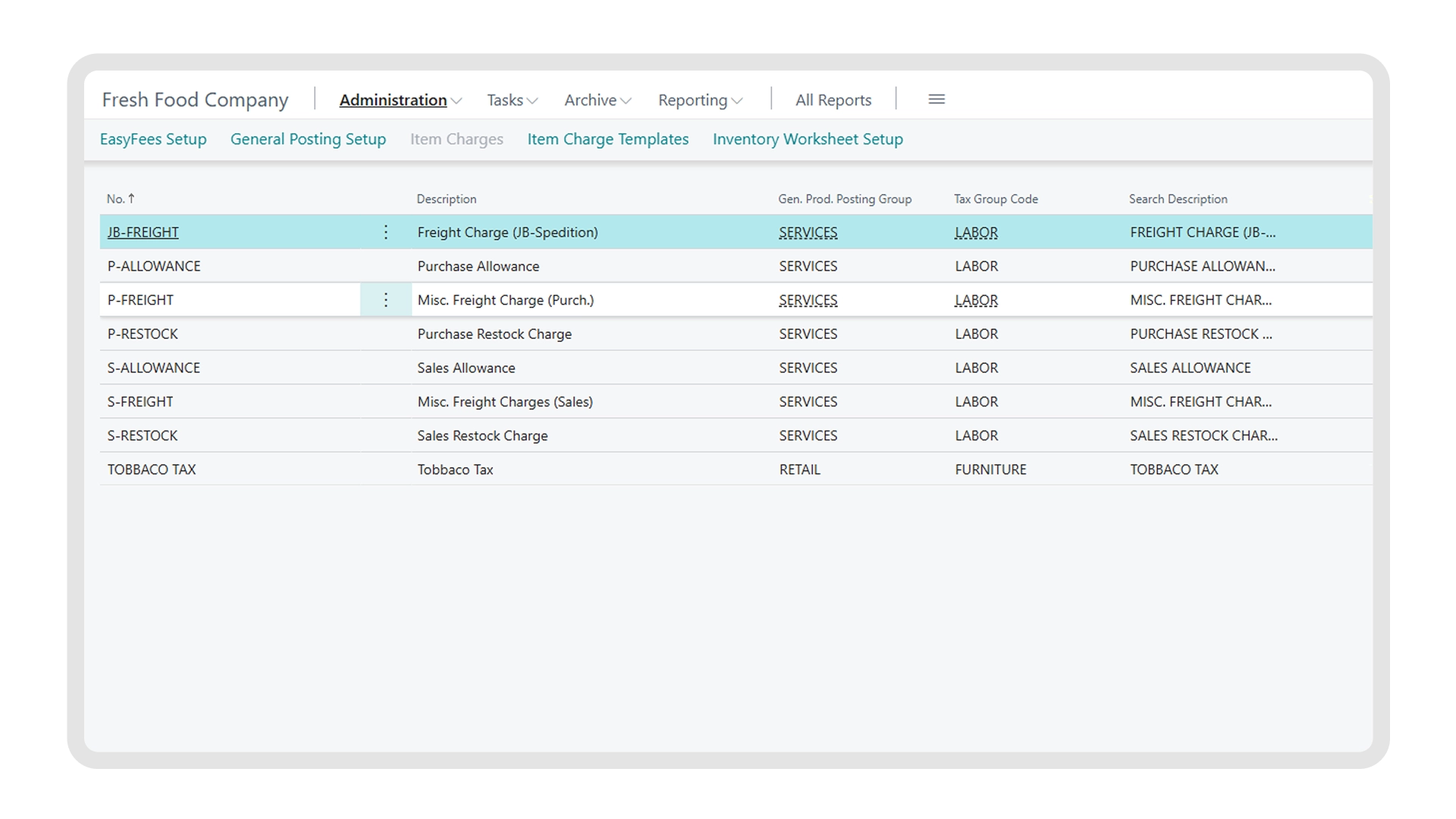

Flexible Tax Templates

Assign templates to items to calculate fees due to specific jurisdictions. These templates act as worksheets, making fees management simpler and more efficient.

Outbound

Outbound fee is automatically added to sales documents and passed to customers. With EasyFEES, you can also direct Inbound and Outbound fees to different General Ledger accounts as needed.

Detailed Reporting

All fees’ entries are logged for complete transparency. At the end of each month, generate comprehensive reports to review fees due by product, category, or fee bracket.

Support for Importers

EasyFEES is ideal for businesses dealing with imports. Duties, fees, and other costs can be added to the cost of goods based on assigned templates, ensuring accurate pricing.

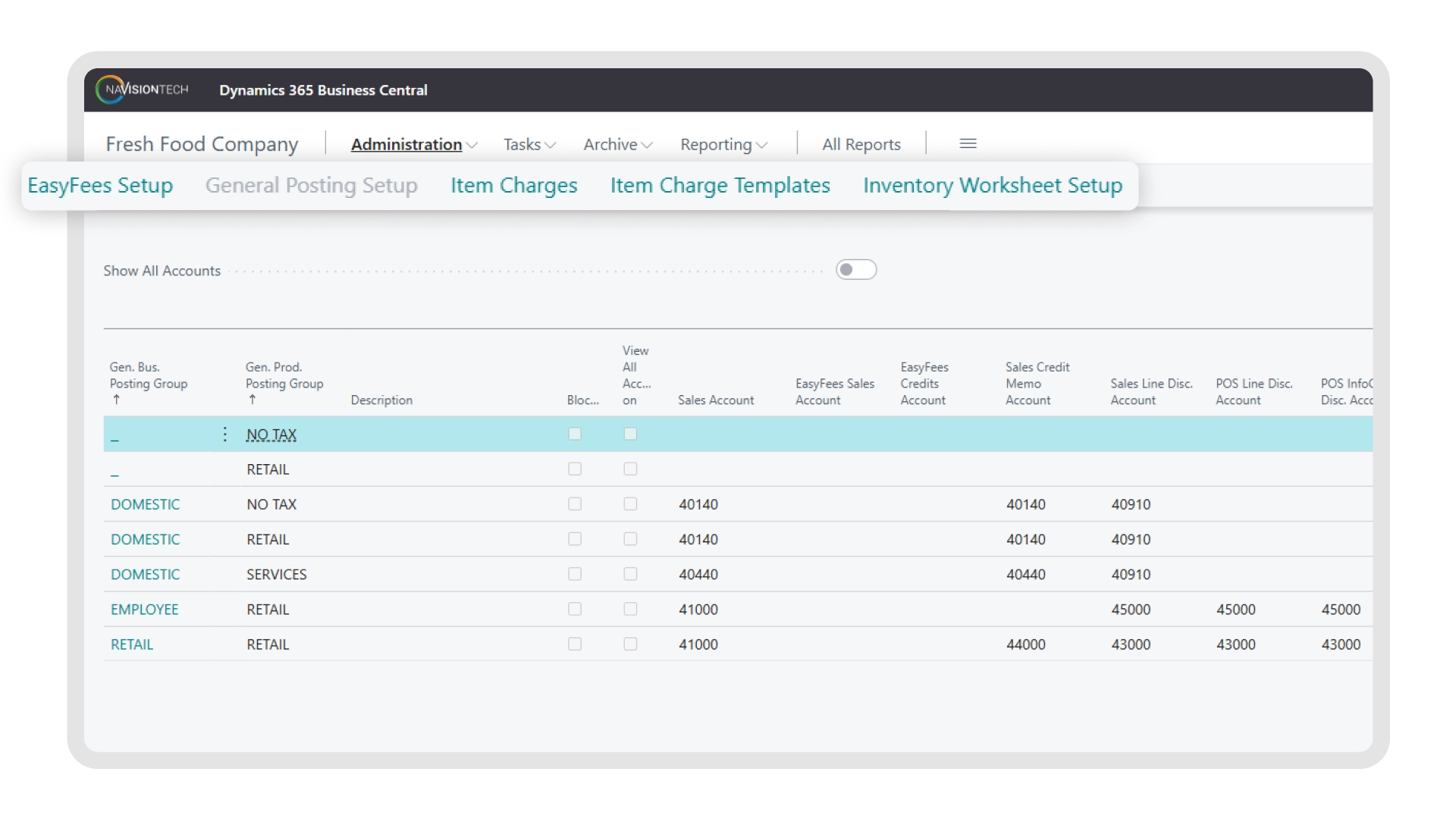

Integration

If you’re using Dynamics 365 Business Central or LS Retail in your environment, EasyFEES works seamlessly to manage taxes alongside your wholesale and retail operations.

Stay Connected